Max Cash Financial Resources Toolkit

Welcome to the Max Cash® Financial Resources Toolkit! We’ve provided a comprehensive set of resources to help you manage and track your finances effectively. Whether your goal is to learn how to budget for the first time, pay off debt, or prioritize your loan payments, you can find the tools to succeed and reach financial freedom!

Need to pay off a loan? Have debt you need to tackle? We’ve got you covered.2 5

Get the Right Tools in Your Toolbox

Learning how to manage your money may seem complicated, but with access to the right resources, you can make a plan for your money and find stability with your finances. Decide what you want to accomplish with your money and take a closer look at the available resources below to walk down the right path to financial freedom.

Key Takeaways of the Max Cash Budgeting Toolkit

- Gain Control Over Your Finances

- Strategically Reduce Debt

- Calculate Your Loan Payments

- Understand Your Net Worth

- Challenge Yourself to Save More

- Achieve Financial Well-Being and Peace of Mind

Remember, financial success can be within reach with the right tools and strategies. Let Max Cash® help you start this journey to a brighter financial future!2 5

Where to Get Started

The Entire Max Cash Financial Resources Toolkit

Unlock the entire Max Cash® financial resources toolkit for FREE! This ultimate toolkit includes everything you need to take a hands-on approach towards financial freedom and better money management.

- Personal Budget

- Payoff Calculator

- Net Worth Tracker

- Debt Snowball Strategy

- Savings Challenge

- Much More!

Budget Creation Resources

Max Cash® has compiled a range of samples, guides, and worksheets to assist you in creating a personalized budget tailored to your financial goals. Explore these resources to gain more insight into your new plan for your income, expenses, and annual savings targets.

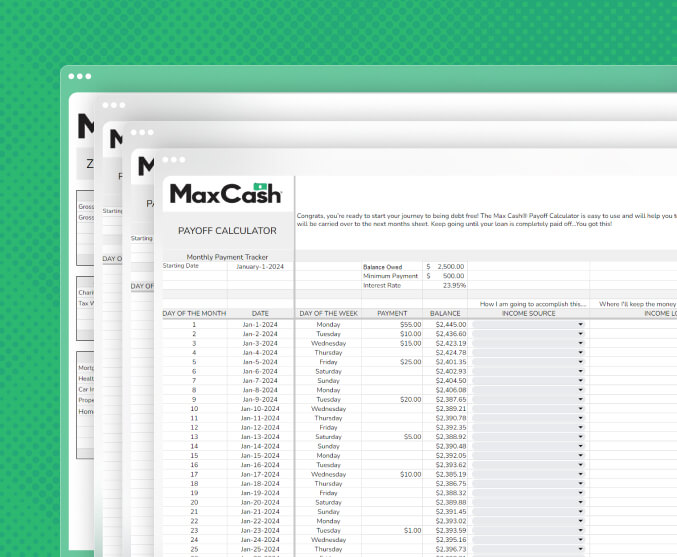

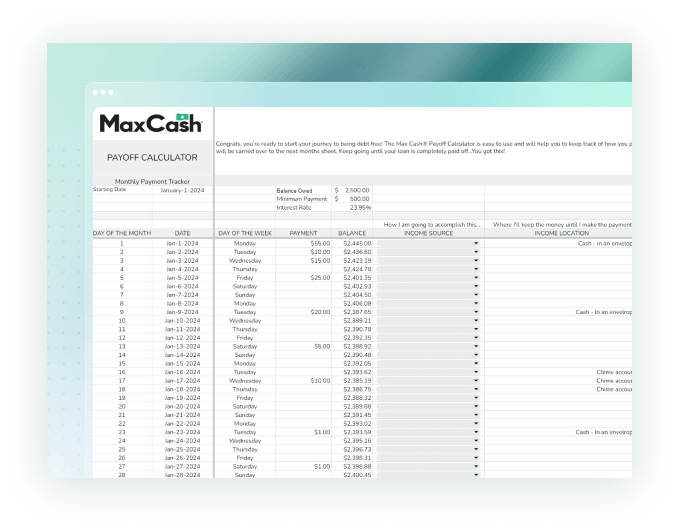

Payoff Calculator

Use the downloadable spreadsheet to effectively plan and track your monthly payments to your debt obligations on a weekly and monthly basis. Through this streamlined tracking method, you can easily estimate your payoff date and start your journey toward becoming debt-free.

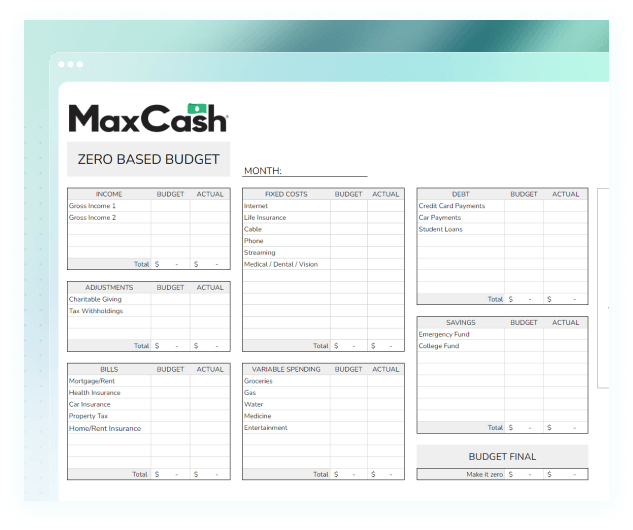

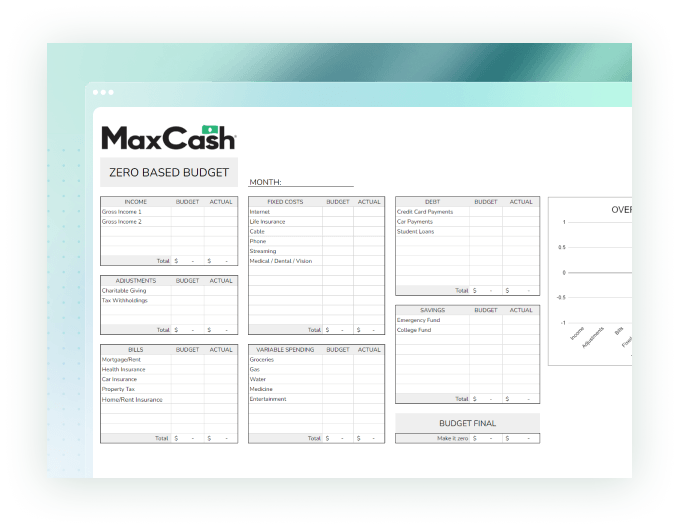

Online Budget Tracking

The budget tracking PDFs are customizable and designed to simplify monitoring your financial transactions by creating a plan for tracking and allocating your gross monthly income. Choose between zero-based budgets, annual budgets, and more!

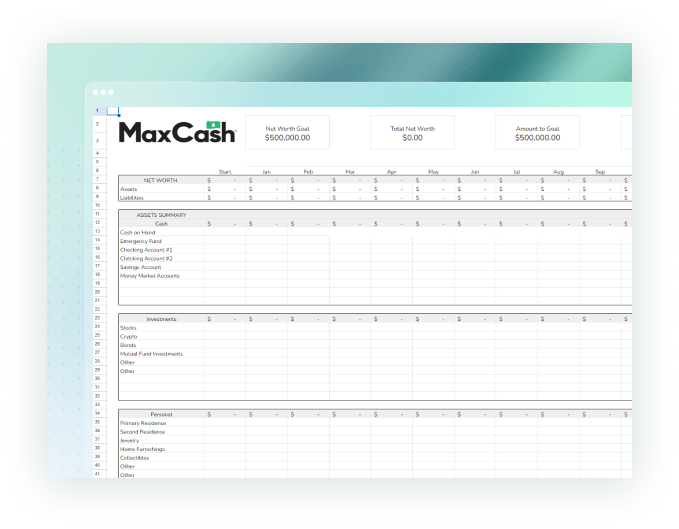

Determining Total Net Worth

Accurately calculating your net worth is crucial for assessing your overall financial health and planning for your future. Max Cash® provides a resourceful guide to calculate your net worth and assess your situation. Discover how your assets and liabilities contribute to your overall financial picture.

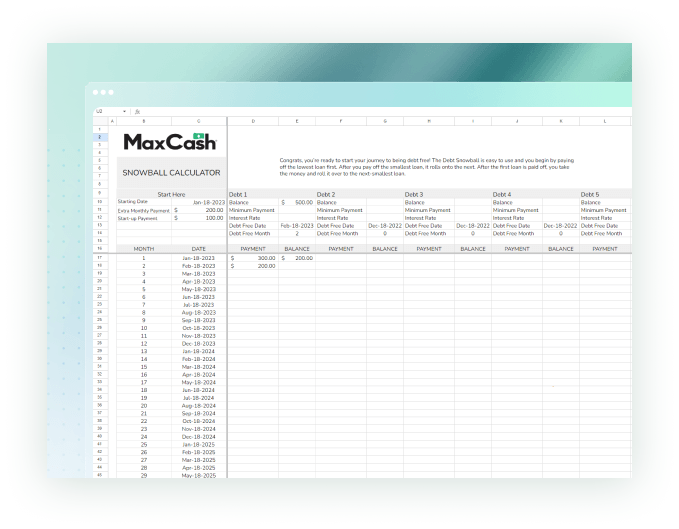

Debt Snowball Strategy

Tackling debt can be overwhelming, but Max Cash® is here to guide you through the basics of the debt snowball strategy so that you can learn how to prioritize and pay off your debts systematically. Start with the smallest balances to build the right momentum towards financial freedom!

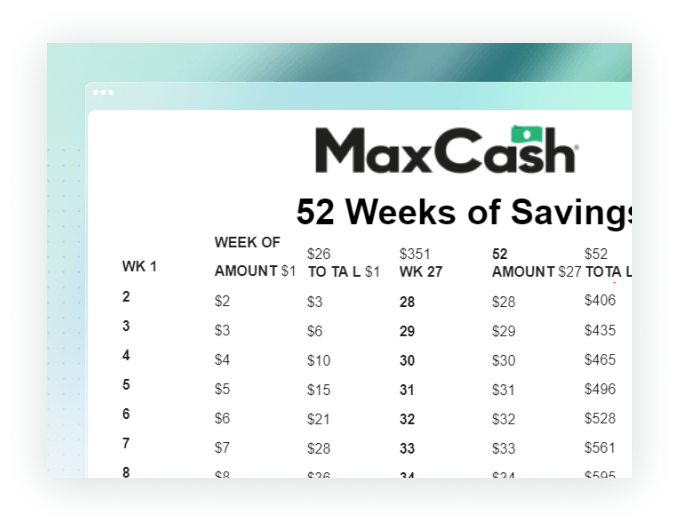

Challenge Yourself to Save More

Take a closer look at the savings goals week by week and challenge yourself to start prioritizing your savings! Whether you need to build up an emergency fund or save for a rainy day, one of the most important aspects of financial planning is having a safety net through a savings account.