Affirm is a BN/PL platform, also known as a Buy Now, Pay Later option, that you’ll often see when checking out on your favorite website. You can finance your purchases from authorized users monthly or bi-weekly through loans from Affirm and take care of larger expenses that may be out of your budget to pay… Continue reading Can You Get a Cash Advance From Affirm?

What Happens if You Default on a Title Loan?

What Happens if You Default on a Title Loan? Life happens, and your financial situation can change in a flash. If you took out a loan against your car and you’re struggling to make payments, you may be wondering what happens if you default on a title loan. The answer is not as cut and… Continue reading What Happens if You Default on a Title Loan?

Can I Get A Cash Advance Without a Bank Account?

Do I Need a Bank Account To Get a Cash Advance? Need instant cash but don’t have a bank account? The 2023 FDIC National Survey of Unbanked and Underbanked Households found that 5.6 million households are in the same boat, meaning that they don’t consistently have an active checking or savings account. Without access to… Continue reading Can I Get A Cash Advance Without a Bank Account?

How to Get a $500 Cash Advance with No Credit Check

Being unable to make ends meet can make you feel defeated, but you aren’t alone. As the cost of living increases, an estimated 37% of Americans in a 2024 survey by the Federal Reserve would likely struggle to handle emergency expenses of $400 or more. If you’re searching for a $500 cash advance with no… Continue reading How to Get a $500 Cash Advance with No Credit Check

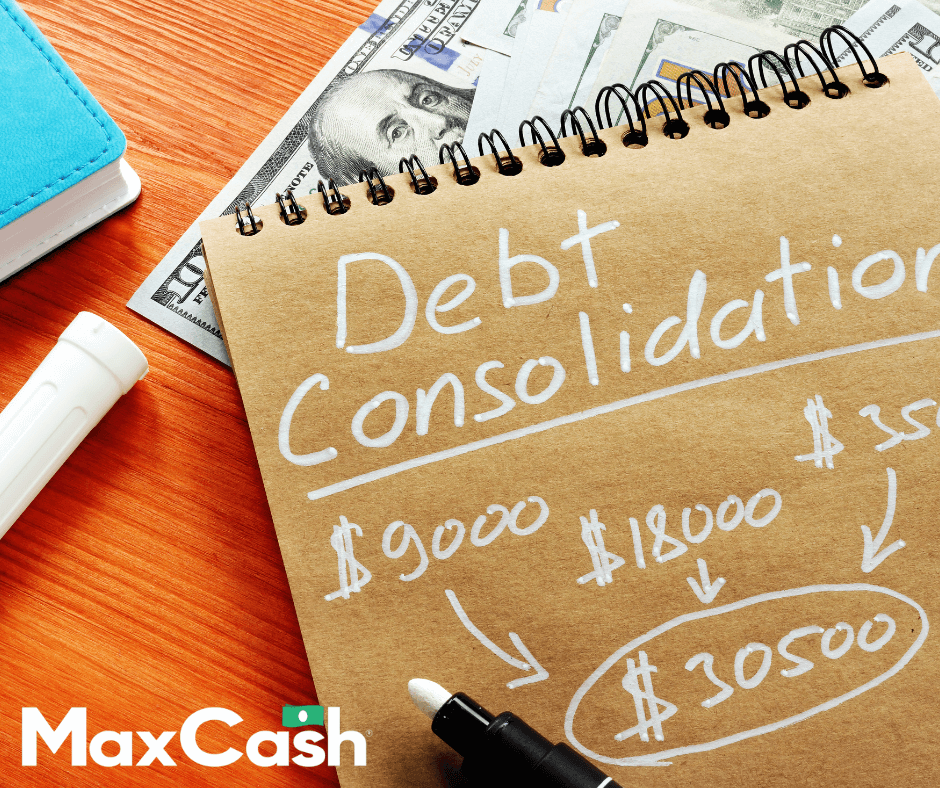

How Do You Get Out Of Payday Loan Debt?

Payday loans can help you bridge the gap between your paychecks to help you get your finances back together. But if you are hit with unexpected expenses and your financial situation changes, you might be wondering – how do you get out of payday loan debt? While it isn’t impossible, getting payday loan relief requires… Continue reading How Do You Get Out Of Payday Loan Debt?

Can You File for Bankruptcy On Personal Loans?

How Can You File for Bankruptcy on Personal Loans? Are you in over your head financially? You are not alone, but you may be wondering, “Can you file for bankruptcy on personal loans?” While the secured debt that you owe when filing for Chapter 7 or 13 Bankruptcy will typically not be discharged during the… Continue reading Can You File for Bankruptcy On Personal Loans?

Guide to What is a Financial Emergency and a Non-Emergency

How to Contrast the Difference Between a Financial Emergency and a Non-Emergency? Understanding the difference between a financial emergency and a non-emergency can help you break down your budget more effectively and make a plan for your finances. For starters, financial emergencies are expenses that you did not plan for and need to be solved… Continue reading Guide to What is a Financial Emergency and a Non-Emergency

Can You Get Points For Cash Advances?

Generally, you won’t be able to get points for cash advances. Using your credit card to access a cash advance means you are borrowing a portion of your available credit, and it’s not the same as making a purchase with your credit card to earn points or airline miles. Since credit card cash advances often… Continue reading Can You Get Points For Cash Advances?

Balance Transfer Auto Loan

Can I Do a Balance Transfer for an Auto Loan? The Federal Reserve is tying recent high rates of auto loan delinquencies to high monthly payments in 2025. The average payment on a car loan is around $500, so it’s not surprising that Americans are struggling to make ends meet. One of the ways to… Continue reading Balance Transfer Auto Loan

Find Loans for Rental Assistance

Loans for Rental Assistance: What are Your Options? A new study from Redfin shows that half of U.S. homeowners and renters are struggling to afford their housing payments. Now more than ever, Americans are skipping meals and working more hours to afford the cost of rent and other housing obligations. So you might be wondering,… Continue reading Find Loans for Rental Assistance