Pack Your Bags. We’ve Got the Expense.

Get a Vacation Loan — Even with Bad Credit

Life’s too short to keep postponing paradise. Whether it’s a beach escape, mountain retreat, or long-overdue family trip — you can get connected to loans to make it happen now, not later.5

No hidden fees.3 No judgment. Just quick personal loans that fund your next great escape.

What is a Vacation Loan?

A vacation loan is a personal loan used to fund travel — from flights and hotels to experiences and excursions. You borrow a lump sum and repay it in fixed monthly payments.

At Max Cash, we help you find offers that fit your budget — even if your credit’s taken a few detours.

Can I Get a Vacation Loan with Bad Credit?

Absolutely.

We partner with lenders who look at the full picture — not just your credit score. 5

Ready for your dream vacation plan?

Why Travel with Max Cash® in Your Corner?

We make borrowing simple — no confusing forms, no dead ends, no credit shame.

It’s not just a trip. It’s a memory in the making.

Let Max Cash help you get there.

You Pick the Destination

We’ll help with the money part.

We Show You Loan Options

Personalized offers from lenders who get real life.

You Pack, Book & Go

Choose what fits — and make those travel dreams real.

Real Support, No Scripts

Questions? Concerns? Our support team speaks human — not robot — to help connect you with optimal solutions. 5

Why Choose Max Cash for your $100 loans

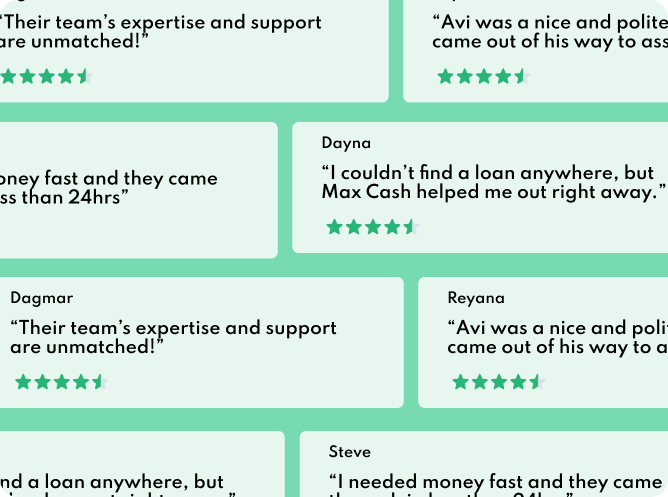

Max Cash has serviced over 13 million people nationwide. With real-human customer support standing by 24×7 and over a decade of experience connecting consumers to premier financial services, we are committed to striving for excellence in assisting your financial needs.

Vacation Loans

Frequently Asked Questions

The best loan for a vacation depends on your budget, travel timeline, and repayment preferences. Common options include personal loans, credit cards, and in some cases, title loans. A personal loan provides a lump sum with fixed monthly payments, making it ideal for covering airfare, hotels, and activities without relying on high-interest credit cards.2

If you own a vehicle, a title loan could help you access funds quickly, though it’s secured by your car and carries the risk of repossession if you default. Credit cards may offer rewards or travel perks but can become costly if you don’t pay the balance in full.4

Eligibility varies depending on the loan type. For unsecured personal loans, lenders usually look at your credit score and debt-to-income ratio. Title loans may have more lenient credit score requirements but require sufficient equity in your vehicle.1 Some lenders also work with borrowers who have bad credit.5

Many personal loans can fund in 1–3 business days, while some title loans or payday loans may fund the same day or by the next business day.1 If you’re booking last-minute travel, consider lenders that offer expedited processing.5

A personal loan offers installment payments and a defined payoff date, making it easier to budget. Credit cards may be convenient and provide travel rewards, but interest rates are often higher unless you can pay the balance quickly.4

Yes, some lenders in the Max Cash® network offer vacation loan options for borrowers with less-than-perfect credit.2 This could include title loans, certain personal loans, or installment loans. However, approval depends on multiple factors, and funding is not guaranteed.5