When Health Hits Hard, We Help.

Loans that help you heal — even with bad credit.

From ER visits to dental work, Max Cash helps you find fast, flexible loan options so you can focus on healing — not stressing over the bill. 2 5

What is a Medical Loan?

A medical loan typically is a type of personal loan used to pay for healthcare expenses — including surgeries, dental procedures, hospital stays, prescriptions, or emergencies.

Unlike insurance claims or credit cards, medical loans offer upfront funds with fixed monthly payments, so you can cover costs immediately and repay over time.

At Max Cash, we help match you with lenders who understand real-life medical needs — no judgment, just support. 5

Can I Get a Medical Loan with Bad Credit?

Yes. Medical emergencies don’t wait for perfect credit — and neither do we.

Max Cash works with lenders who assess more than just your credit score. That means your income, job status, and ability to repay matter more than a past financial slip. 5

Planned or emergency. Get loan options fast.5

How Max Cash® Makes Medical Loans Easy

We make borrowing simple — no confusing forms, no dead ends, no credit shame. Here’s what sets Max Cash® apart:2 5

You Tell Us What You Need

Quick form. No hard credit check to get started. 2 5

We Show You Real Options

Get matched with lenders offering transparent rates — no surprises.

You Choose & Get Funded

Pick the offer that works best for you. Money could arrive as soon as the next day.*

Real Support, No Scripts

Questions? Concerns? Our support team speaks human — not robot — to help connect you with optimal solutions. 5

Why Choose Max Cash for your $100 loans

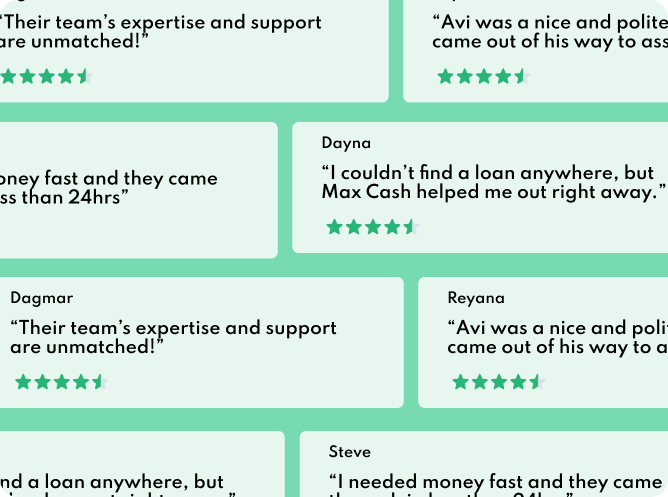

Max Cash has serviced over 13 million people nationwide. With real-human customer support standing by 24×7 and over a decade of experience connecting consumers to premier financial services, we are committed to striving for excellence in assisting your financial needs.

Medical Loans

Frequently Asked Questions

The best loan for medical expenses depends on how urgent your needs are, the total cost, and your financial situation. Common options include personal loans, medical credit cards, payday loans, and title loans. A personal loan is often ideal for larger medical bills, offering fixed interest rates and predictable payments.2 Payday loans can be faster to fund for smaller, urgent costs, but have shorter loan terms. Title loans can allow you to borrow against your vehicle’s value¹ sometimes up to half or more but require using your car as collateral. If your healthcare provider offers a payment plan or financing partner, this may be another option to explore. Always compare the total cost of borrowing, including interest and fees, before committing.4

Eligibility varies depending on the type of loan and the lender’s requirements. Many lenders will review your credit score, income, and debt-to-income ratio.2 However, some payday and title loan lenders may have more lenient credit criteria, making it possible to qualify even with poor credit.5

For unsecured personal loans, you generally need stable income and a credit profile that meets the lender’s minimum requirements. For secured loans like title loans, you typically must own the asset (such as your car) outright or have significant equity in it.3

Many lenders understand that medical expenses can’t wait. Depending on the loan type and lender, funds can be deposited as soon as the same day or next business day if your application is approved.2 Payday loans and title loans often have fast funding timelines, while personal loans may take a few days to process depending on the lender or loan servicer.2

A personal loan typically offers a longer repayment period, making it better suited for large or ongoing medical expenses if you qualify. Payday loans can be useful for smaller, urgent medical costs when speed matters most, but they tend to have shorter terms. 2 4

If your credit is poor and you need immediate funds, a title loan may be another option — but be aware of the risk of losing your collateral if you default on the loan.1 Always review the loan terms carefully to choose the option that best fits your budget and timeline.5

Yes, some lenders in the Max Cash® network work with borrowers who have bad credit.2 Even if you’ve been turned down by traditional lenders, you may still qualify for certain loan types, including title loans and payday loans. However, loan amounts, rates, and terms vary by state and lender, and approval is never guaranteed. 4 5