Furnish Now. Pay Later.

Flexible Furniture Loans — Even with Bad Credit

Whether you’re upgrading your living room, replacing a worn-out mattress, or buying that dream dining set — Max Cash helps you afford it now without draining your savings.

We connect you with lenders offering personal loans tailored for furniture purchases. No collateral. No awkward showroom financing. Just simple, stress-free borrowing. 2 5

What is a Furniture Loan?

A furniture loan is a type of personal loan that helps you finance new furniture without upfront costs. You borrow a lump sum and repay it in fixed monthly installments.

Max Cash makes it easy — even if your credit isn’t perfect. We show you estimated offers so you can shop smart and furnish confidently. 2 5

Can I Get a Furniture Loan with Bad Credit?

Yes. Max Cash works with lenders who understand that your credit score isn’t the full story. You could still qualify based on your income and repayment ability — not just your past.

Comfortable loan, Just like your furniture5

How Max Cash® Helps You Upgrade Without the Wait

We make borrowing simple — no confusing forms, no dead ends, no credit shame. Here’s what sets Max Cash® apart: 2 5

You Tell Us What You Need

Quick form. No hard credit check to get started. 2 5

We Show You Real Options

Get matched with lenders offering transparent rates — no surprises.

You Choose & Get Funded

Pick the offer that works best for you. Money could arrive as soon as the next day.*

Real Support, No Scripts

Questions? Concerns? Our support team speaks human — not robot — to help connect you with optimal solutions. 5

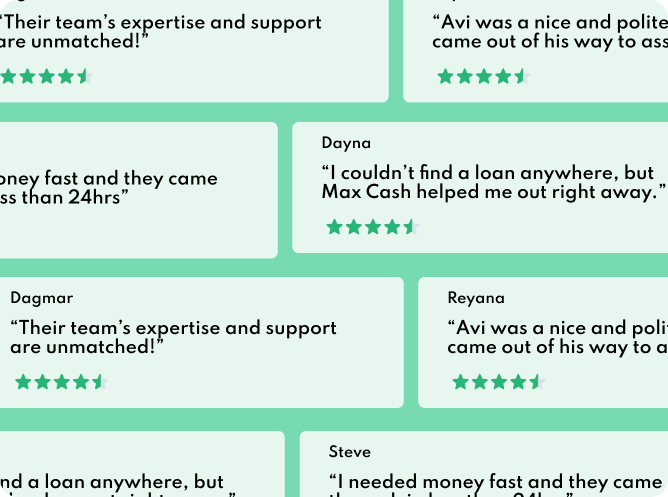

Why Choose Max Cash for your $100 loans

Max Cash has serviced over 13 million people nationwide. With real-human customer support standing by 24×7 and over a decade of experience connecting consumers to premier financial services, we are committed to striving for excellence in assisting your financial needs.

Furniture Loans

Frequently Asked Questions

The best loan for furniture purchases depends on how quickly you need the items, the total cost, and your budget for repayment. Common options include personal loans, store financing & Credit Cards. A personal loan can often provide a fixed interest rate and more predictable payments, making it an option for larger purchases.2 Store financing may offer promotional interest rates, but be sure to check for deferred interest clauses that could raise costs if not paid off on time.4

If you own a vehicle, a title loan could let you borrow against its value1 for immediate funds, though it comes with the risk of losing the asset if you default.

Eligibility depends on the loan type and lender requirements. For unsecured personal loans, lenders typically review your credit score, income stability, and debt-to-income ratio.2 For store financing, you may need to meet in-house credit approval criteria.

Title loans are secured by your vehicle, so credit score requirements may be lower, but you must own the vehicle outright or have significant equity in it.3 Some lenders also work with borrowers who have bad credit.5

Funding timelines vary by loan type. Personal loans often fund within 1–3 business days, while payday or title loans may provide same-day or next-business-day funding.1 Store financing approval can be instant if you apply in-store or online during checkout.5

Paying in cash helps you avoid interest charges entirely. However, financing can make sense for larger purchases if it allows you to spread payments over time without straining your budget.2 Look for low or zero-interest promotional financing but read the fine print to avoid unexpected charges.4 If you need fast delivery and don’t have enough cash, a personal or title loan1 could bridge the gap.

Yes, some lenders in the Max Cash® network work with borrowers who have bad credit.2 5 Options may include title loans, certain personal loans, or store financing with flexible credit approval. However, terms and rates vary, and approval is never guaranteed.5