Top Credit Score Offers for February 2026

At Max Cash, we’ve curated exclusive offers to help you take control of your financial journey, from boosting your credit score to securing better loan rates.2 Don’t miss out on these offers to unlock the power of your credit score!

YourScoreAndMore

Key Features

- Unlimited Access to Your Credit Score: Stay informed with instant updates anytime, helping you monitor your financial health.

- Automatic Credit Monitoring with Alerts: Receive timely notifications on any changes to your credit report to protect against fraud.

- Identity Theft Protection: Safeguard your personal information with proactive fraud alerts.

On YourScoreAndMore Website

The Ultimate Credit Score Guide

Navigate your path to a stronger credit profile today with some help from Max Cash®!2 Learn how to boost your credit score and gain a deeper understanding of your credit report. This guide covers everything from strategies to raise your score and reduce credit utilization to protecting your credit through proactive monitoring.

- What is Credit Score?

- How Can I Improve My Credit Score?

- How Can I Lower My Credit Utilization?

- How Can I Freeze My Credit?

- Average Credit Score Range

- How Often Should I Check My Credit Score?

- Can I Check My Credit Report Without Affecting My Score?

- What is a Credit Score? x

What is a Credit Score?

A credit score is a number that represents your creditworthiness, which lenders will consider when deciding whether to offer you a loan or new credit. The most common type is the FICO score, which is between 300 and 850.

If you have a high credit score, it means you’re likely to pay back your loans or other debt obligations on time. A low score means there’s a higher chance you won’t. In addition to affecting your chances of getting a loan, your credit score also affects the interest rate you get.

For example, a person with a high credit score may be able to get a loan with a lower interest rate, while a person with a low credit score may be charged a higher interest rate or may not be approved for a loan at your credit score isn’t just important when you’re applying for a loan or credit card. Your car insurance rate, rental applications, and even employment opportunities can all be impacted by your credit score.

- How Can I Improve My Credit Score? x

How Can I Improve My Credit Score?

Improving your credit score is incredibly important for several reasons, and it comes with numerous benefits. A good credit score can open doors to financial opportunities and save you money in the long run. Here are some simple steps to improve your credit score:

- Pay Bills on Time: Late payments can lower your score. Always pay your bills on time.

- Reduce Your Debt: High amounts of debt can also negatively impact your score. Try to pay down your debts as much as possible. This helps with your credit utilization, which is how much credit you’re using compared to what you have available.

- Keep Old Credit Accounts Open: Closing old credit accounts can shorten your credit history, which can have an adverse effect on your credit score. So, keeping your older credit accounts open is good, even if you’re not using them.

- Dispute Errors: Always check your credit reports. If you find any mistakes, report them to the credit bureau and the creditor.

- Limit New Credit Applications: Applying for a lot of new credit in a short amount of time can also lower your score. Try to limit how often you apply for new credit cards or loans.

- Diversify Your Credit: Having different types of credit, like credit cards, personal loans, and car loans, can be good for your score.

Remember that improving your credit score takes time and consistent effort. Following these steps can help you increase your score over time.

- How Can I Lower My Credit Utilization? x

How Can I Lower My Credit Utilization?

Credit utilization is about how much of your available credit you’re using. It’s important for your credit score. A high credit utilization can lower your score. Here are ways to lower it:

- Pay Down Debts: Paying off your credit card debts is a good way to reduce your credit utilization. The more you pay off, the lower your ratio will be.

- Increase Your Credit Limits: Ask your credit card company to raise your limits. This works if you’ve got a good history of paying on time.

- Use Less Credit: Try to cut back on how much you use your credit cards. This will naturally bring down your credit utilization.

- Balance Transfer Cards: Consider transferring your balance to a card with a lower interest rate. This can help you pay down your balance faster and lower your utilization.

- Diversify Your Credit: Having a mix of credit types, like cards and loans, can help spread out your credit usage.

Remember, reducing your credit utilization is a great way to improve your credit score, but it’s not the only factor. Keep this in mind as you work on your credit.

- How Can I Freeze My Credit? x

How Can I Freeze My Credit?

A credit freeze, or a security freeze, stops new credit, like loans or credit cards, from being opened in your name without your permission. It’s a good way to keep identity thieves from using your name and harming your credit score. Here’s how to do a credit freeze:

- Contact Each Credit Bureau: Reach out to Equifax, Experian, and TransUnion. You can call, mail, or go online. You’ll need to give them your details like name, address, date of birth, and Social Security number.

- Request a Freeze: Ask them to put a freeze on your credit. This means companies can’t access your credit report without your say-so. This includes banks and credit card companies.

- Get a PIN: Each bureau will give you a Personal Identification Number (PIN) or password you will use when you want to temporarily lift the freeze or permanently remove it.

- Consider Your Family: If your information is compromised, think about freezing your family’s credit too. It can help prevent identity theft for them as well.

Remember, a credit freeze doesn’t affect your credit score. You can still use your existing credit accounts. It just makes it hard for someone else to open new credit in your name and helps protect against identity theft by keeping your credit report private.

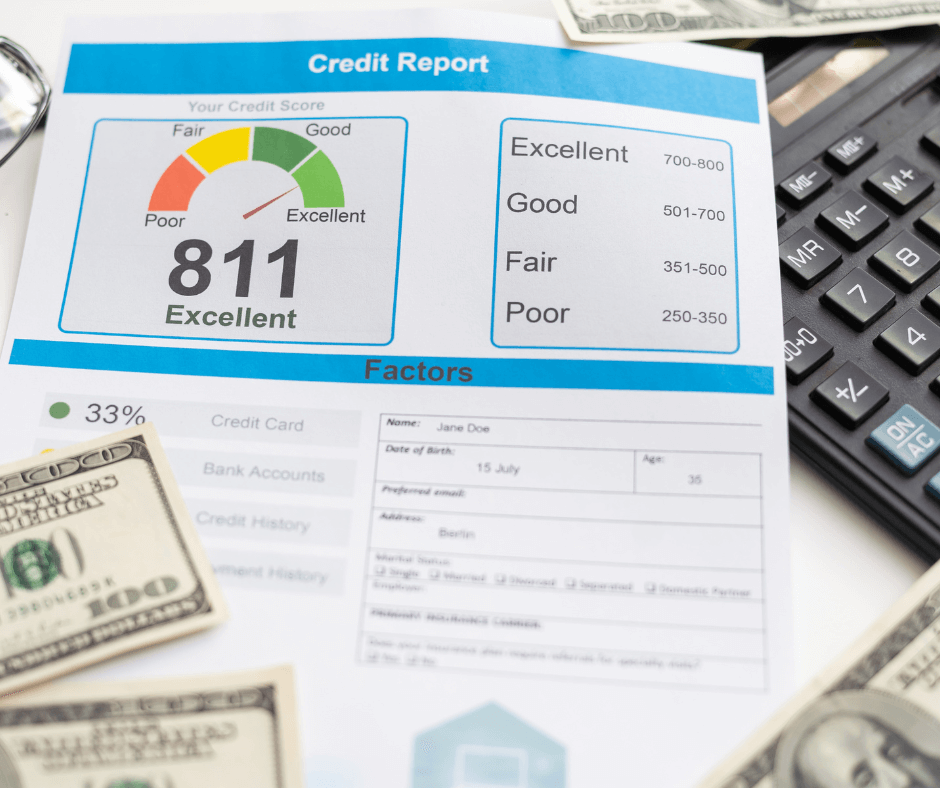

- Average Credit Score Range x

Average Credit Score Range

The average credit score range in the United States typically falls between 300 and 850. This common range is determined by the FICO scoring system, and although it is not the only scoring system, it is one of the most widely used credit scoring models. Credit scores within this range are often categorized as follows:

- Excellent Credit: 800 – 850

- Very Good Credit: 740 – 799

- Good Credit: 670 – 739

- Fair Credit: 580 – 669

- Poor Credit: 300 – 579

The average FICO score for U.S. consumers was approximately 718 in 2023. It’s important to keep in mind that these ranges can vary slightly depending on the credit scoring model in use, such as FICO or VantageScore, but they generally follow a similar pattern.

- How Often Should I Check My Credit Score? x

How Often Should I Check My Credit Score?

Checking your credit score regularly is essential for accuracy and security. Here’s how often you should do it:

- Annually: Check your score at least once a year, as you’re entitled to a free annual credit report from each of the three major credit bureaus.

- Before Credit Applications: Review your score before applying for loans or credit to gauge your creditworthiness and decide whether to proceed.

- Identity Theft Suspicions: If you suspect identity theft, check your credit report promptly and report any suspicious activity to authorities and credit bureaus.

- Improvement Efforts: If you’re actively working on improving your credit, consider more frequent checks to track your progress.

Remember, checking your own score has no impact, unlike inquiries from lenders. Regular monitoring is a responsible credit management practice.

- Can I Check My Credit Report Without Affecting My Score? x

Can I Check My Credit Report Without Affecting My Score?

Yes, you can check your credit report without impacting your credit score through what’s known as a “soft inquiry” or “soft pull.” When you request your credit report, the credit reporting bureau verifies your identity and provides the report. This type of inquiry doesn’t get reported to third parties and has no effect on your credit score. Importantly, a soft pull doesn’t appear on your credit report and remains invisible to other lenders or creditors.

Here are ways to check your credit report without affecting your credit score:

- Annual Credit Report: You can obtain a free credit report once a year from each major credit reporting bureau through the Annual Credit Report Request Service.

- Credit Card Companies and Financial Institutions: Some credit card companies, financial institutions, and personal finance websites offer free credit report and score check services.

- Credit Monitoring Services: Consider using a credit monitoring service that provides ongoing access to your credit report.

Regularly reviewing your credit report helps ensure its accuracy and allows you to report any suspicious activity that could indicate identity theft. This responsible practice helps maintain a healthy credit score and early detection of potential issues.

Max Cash Credit Score Articles